- This event has passed.

IFSB-FIS E-Workshop Series : Regulatory Capital for Islamic Banks

November 9, 2020 @ 4:30 PM – 6:30 PM

Date: 9 November 2020 (Monday)

Time: 4:30 – 6:30 pm (MYT)

Sector: Islamic banking

Topic: Regulatory Capital for Islamic Banks

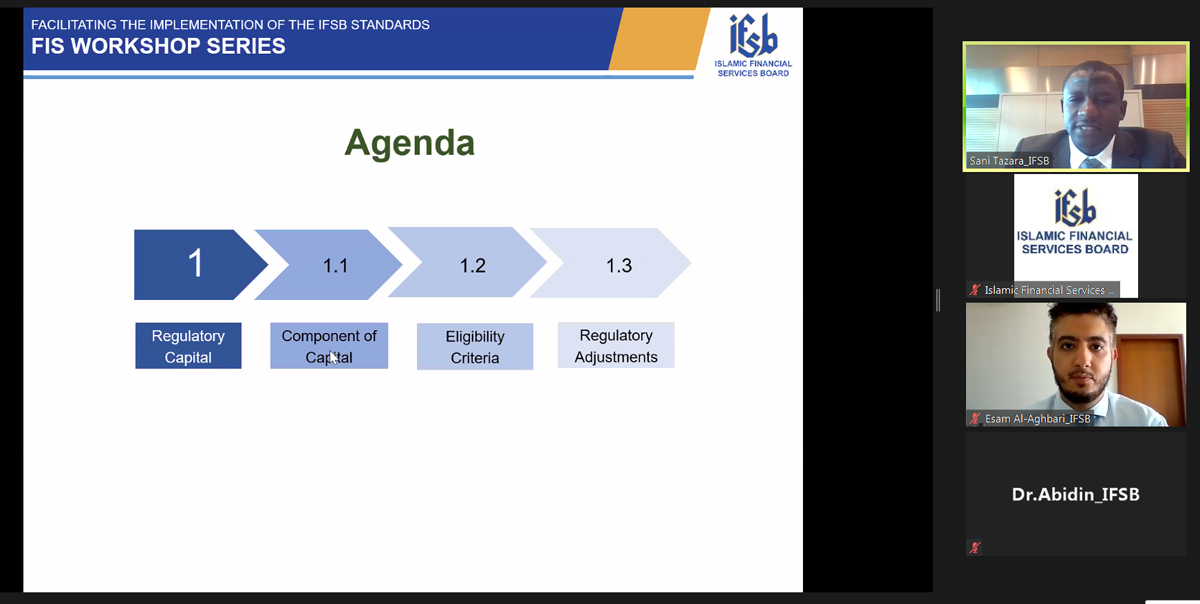

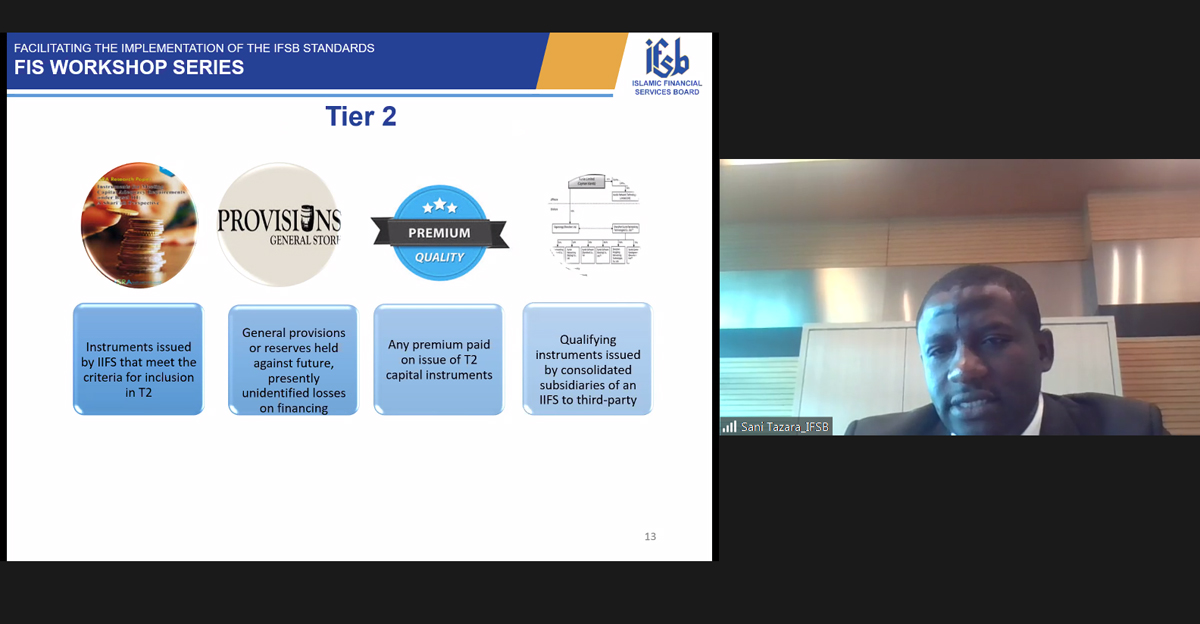

Overview In this e-workshop session, the IFSB will be discussing banks regulatory capital, by addressing the specificities of Islamic banking operations and business activities. Regulatory capital requirements were introduced as a prudential measure with the aim of ensuring that risk exposures of a financial institution are adequately supported by high-quality capital that absorbs losses on a going concern basis. This ensures that financial institutions meet their obligations on an ongoing basis as they fall due, while also maintaining the confidence of customers, depositors, creditors and other stakeholders in their dealings with the institution and thereby promoting the resilience and stability of financial systems around the world. Subsequent enhancements to regulatory capital requirements also sought to further protect depositors and other creditors in a gone concern situation by providing an additional cushion of loss-absorbing capital. The basic regulatory capital requirement ensures that financial institutions maintain a minimum capital adequacy ratio at all times. The CAR is a measurement of a financial institution’s available regulatory capital expressed as a percentage of its total risk-weighted assets. We will be taking the participants, in more the details and in a simplified manner, the tiers and components of regulatory capital for Islamic banks, essential eligibility criteria for inclusion in the regulatory capital as well as the necessary regulatory adjustment to the capital that will make its quantification more conservative so that the capital is available at all times to absorb losses.***REGISTRATION IS OPEN FOR MEMBERS ONLY***

Event Snapshots