Kuala Lumpur, MALAYSIA, 7 August 2024 – The Islamic Financial Services Board (IFSB), in collaboration with Bangko Sentral ng Pilipinas (BSP), successfully delivered two Industry Consultation Sessions (ICS) for Regulatory and Supervisory Authorities (RSAs) in the Philippines.

The virtually held event was aimed at those engaged in or developing frameworks and services for the Islamic finance markets, together with the adoption of IFSB standards. The cross-sector participation served as a platform for valuable knowledge exchange and learning, inspiring participants to emulate best practices for local implementations.

This ICS session marks IFSB’s second collaboration with BSP in 2024, following the successful first session on Islamic banking in April. Building on this, the second session delved into Islamic Capital markets (ICM) and Islamic insurance (Takaful), thereby covering all essential regulatory aspects of those respective sectors.

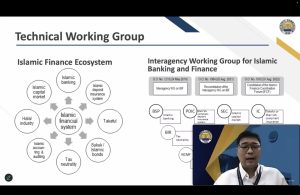

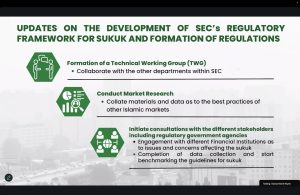

The event began with an opening address by Dr. Abideen Adewale, Acting Assistant Secretary-General for Standard Implementation of the IFSB, and a welcoming address by Commissioner McJill Bryant T. Fernandez of the Securities and Exchange Commission (SEC) Philippines. This was followed by an overview of the country’s insurance and capital market sectors, including regulatory developments and prospects for Islamic capital markets presented by the SEC, and similar themes in the insurance sector by the Insurance Commission. The IFSB team then presented on the implementation of Takaful and ICM standards, outlining practical steps for their adoption in both sectors.

The ICS is designed to offer a comprehensive overview of the foundational principles of Islamic finance, providing actionable insights on adopting and implementing these standards within the regulatory and operational frameworks of financial institutions. This effort aligns with IFSB’s commitment to mainstream Islamic finance by supporting regulatory and supervisory bodies to develop and grow the industry. It fosters cross-sector and cross-regional capacity building, including best practice references for real-life application and mutual learning.

The BSP, an Associate member of the IFSB, has been actively promoting the development of a safe and sound Islamic finance industry in the Philippines. This includes, among others, approval of the first Islamic banking unit license for a conventional bank in June 2023, the maiden sovereign sukuk offering in December 2023, the operationalisation of the Shari’ah Supervisory Board in the BARMM and the latest approval of 2nd Islamic banking unit license for subsidiary bank of a foreign bank.

As the international standard-setting body for regulatory and supervisory agencies, IFSB supports the regulators and financial authorities in the Philippines and similar markets by introducing Shari’ah-compliant standards for the industry. Standardising practices and the adoption of the IFSB standards will further integrate Islamic finance into the global financial services landscape, thereby mainstreaming the Islamic finance industry.

For more information on IFSB and its work, visit www.ifsb.org.