-

-

-

2nd Task Force Meeting of the Technical Note on Microprudential Tools for Islamic Banking

OnlineThe 2nd Task Force Meeting of the Technical Note on Microprudential Tools for Islamic Banking is scheduled to be held as follows: Date 8 December 2022 Time 3.30 PM (GMT +8.00, KL Time) Venue Web conference / webinar Participation in the meeting is open to the Task Force members only. For more information, please email to [email protected]. Event Snapshots

-

41st Islamic Financial Services Board (IFSB) Council Meeting and Side Events

Islamabad Islamabad, Islamabad, PakistanThe 41st IFSB Council Meeting and Side Events are hosted by State Bank of Pakistan. The details of the events are as follows: Tuesday, 13 December 2022 IFSB Capacity Building Programme for Market Players Wednesday, 14 December 2022 IFSB Members and Industry Engagement Session High-level Regulators' Roundtable Welcome Dinner hosted by State Bank of Pakistan (for IFSB members ONLY) Thursday, 15 December 2022 41st IFSB Council Meeting (closed session and by invitation ONLY) Participation in the 41st IFSB Council Meeting and Side Events is by invitation only. Please email your enquiries to Ms. Fadhila at [email protected] and Mrs. Ida Shafinaz at [email protected]. The IFSB and State Bank of Pakistan look forward to welcoming members of the IFSB and Islamic finance industry stakeholders to Islamabad, Pakistan.

-

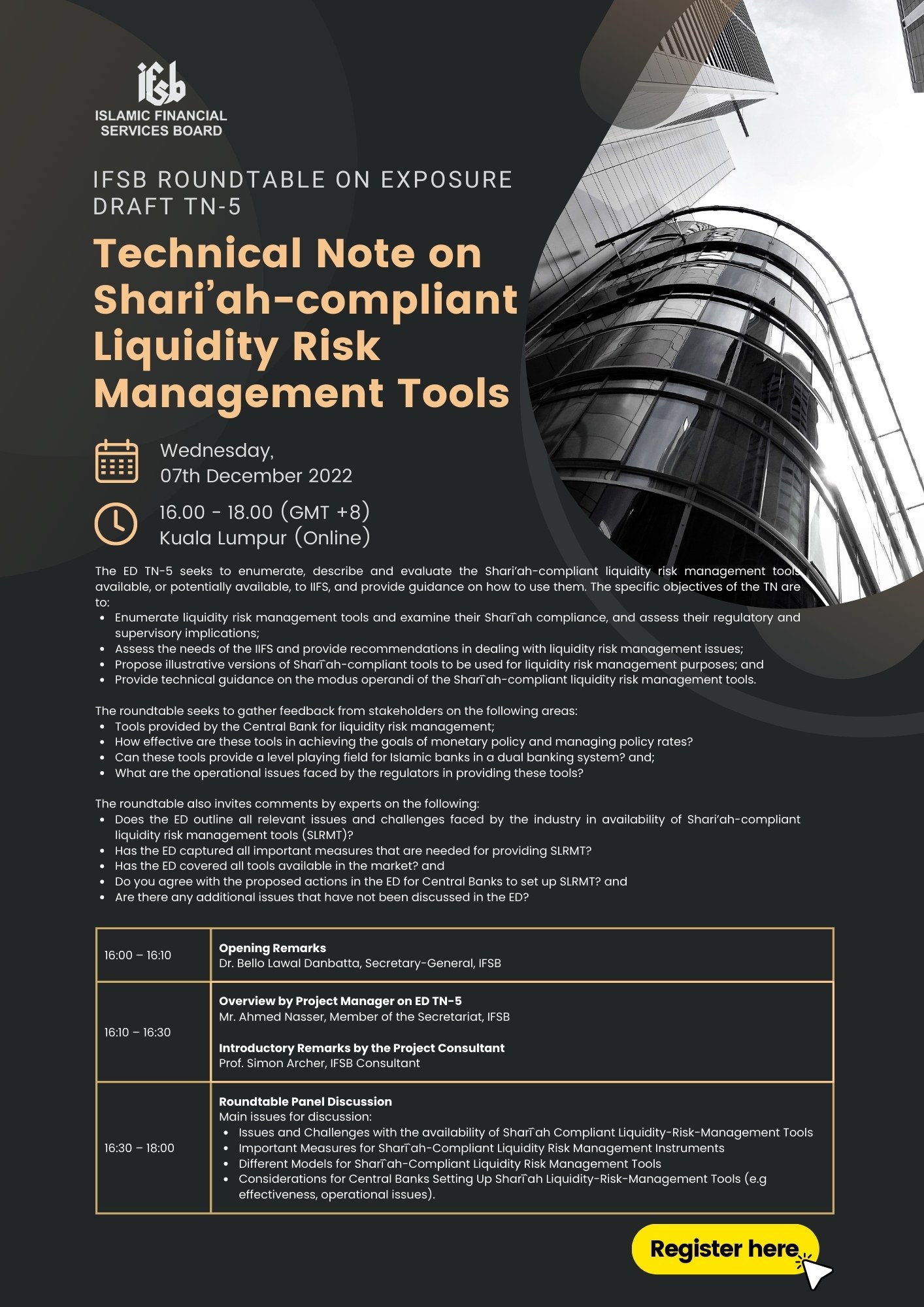

7th Task Force Meeting of Shariah Compliant Liquidity Risk Management Tools Technical Note

OnlineThe 7th Task Force Meeting of Shariah Compliant Liquidity Risk Management Tools Technical Note is scheduled to be held as follows: Date 22 December 2022 Time 4.00 PM (GMT +8.00, KL Time) Venue Web conference / webinar Event Snapshots

-

-

39th Arabic Editing Committee Meeting of the IFSB

OnlineThe 39th Arabic Editing Committee Meeting of the IFSB is scheduled to be held as follow : Date 9 - 12 January 2023 Time 2.00 PM - 6.00 PM (GMT +8.00, KL time) Venue Web conference / webinar Participation in the meeting is open to the Arabic Editing Committee members only. For more information, please email to [email protected].

-

8th Joint Working Group Meeting – IFSB-AAOIFI Revised Shariah Governance Framework

OnlineThe 8th Joint Working Group Meeting - IFSB-AAOIFI Revised Shari'ah Governance Framework is scheduled to be held as follows: Date 12 January 2023 Time 2.30 PM (GMT +8.00, KL Time) Venue Web conference / webinar Participation in the meeting is open to the Working Group members only. For more information, please email to [email protected]. Event Snapshots

-

6th Working Group Meeting Conduct of Business Supervision in Takāful Undertaking

OnlineThe 6th Working Group Meeting Conduct of Business Supervision in Takāful Undertaking is scheduled to be held as follows: Date 26 January 2023 Time 3.30 PM (GMT +8.00, KL Time) Venue Web conference / webinar Participation in the meeting is open to the Working Group members only. For more information, please email to [email protected]. Event Snapshots

-

6th Working Group Meeting – Revised Guiding Principles on Corporate Governance for Institutions Offering Islamic Financial Services – [Banking Segment]

OnlineThe 6th Working Group Meeting - Revised Guiding Principles on Corporate Governance for Institutions Offering Islamic Financial Services - is scheduled to be held as follows: Date 30 January 2023 Time 3.30 PM (GMT +8.00, KL Time) Venue Web conference / webinar Participation in the meeting is open to the Working Group members only. For more information, please email to [email protected]. Event Snapshots

-

-

Regional Facilitating Implementation of IFSB Standards (FIS) Workshop (French)

OnlineAs part of IFSB's objectives in facilitating implementation of IFSB Standards, the IFSB Secretariat consistently offering capacity development initiatives including FIS Workshops for IFSB members. This regional workshop will be conducted virtually on 2 March 2023, covering Islamic banking segment with the following details. SESSION 1 IFSB-1: Guiding Principles of Risk Management for Institutions (other than Insurance Institutions) offering only Islamic Financial Services (IIFS) Understanding risks in IIFS Sound risk management for IIFS Focus on credit, operational, liquidity, rate of return and equity investment risks SESSION 2 IFSB–17: Core Principles for Islamic Finance Regulation (CPIFR) Overview of the Standard Key Principles of the Standard Focus on CPIFR related to: Treatment of Investment Account Holders, Corporate Governance, Shari'ah Governance Framework, Risk Management Process, Capital Adequacy, Islamic "Windows" Operations The workshop will be delivered in French. ***REGISTRATION IS BY INVITATION ONLY***

-

5th Meeting – IFSB IFSI Stability Report 2023 Quality Improvement Committee

OnlineThe 5th Meeting of IFSB IFSI Stability Report 2023 Quality Improvement Committee is scheduled to be held as follows: Date 21 March 2023 Time 3.00 PM (GMT +8.00, KL Time) Venue Web conference / webinar Participation in the meeting is open to the Task Force members only. For more information, please email [email protected].

-

Facilitating Implementation of IFSB Standards (FIS) Workshop for Capital Market Authority (CMA) of Oman

Muscat Muscat, Muscat, OmanAs part of IFSB's objectives in facilitating implementation of IFSB Standards, the IFSB Secretariat consistently offers capacity development initiatives including FIS Workshops for IFSB members. This workshop is dedicated to Capital Market Authority (CMA) in Oman and is conducted alongside with the 59th Technical Meeting in the Sultanate of Oman. The sessions are designed to cover various IFSB Standards that are relevant for Islamic Capital Market and Takaful sectors.

-

Facilitating Implementation of IFSB Standards (FIS) Workshop for Financial Services Authority of Indonesia (OJK)

Bali Bali, Bali, IndonesiaAs part of IFSB's objectives in facilitating implementation of IFSB Standards, the IFSB Secretariat consistently offers capacity development initiatives including FIS Workshops for IFSB members. This workshop is conducted upon the request of the Financial Services Authority of Indonesia (OJK) as a continuation of last year's workshop on IFSB-23 (Revised Capital Adequacy Standard for Institutions Offering Islamic Financial Services (IIFS)). The 2-day workshop aims to discuss deeper on topics relevant to capital adequacy and macroprudential measures, regulatory capital, principles for minimum capital requirements based on credit, market risk and operational risks, capital requirements for