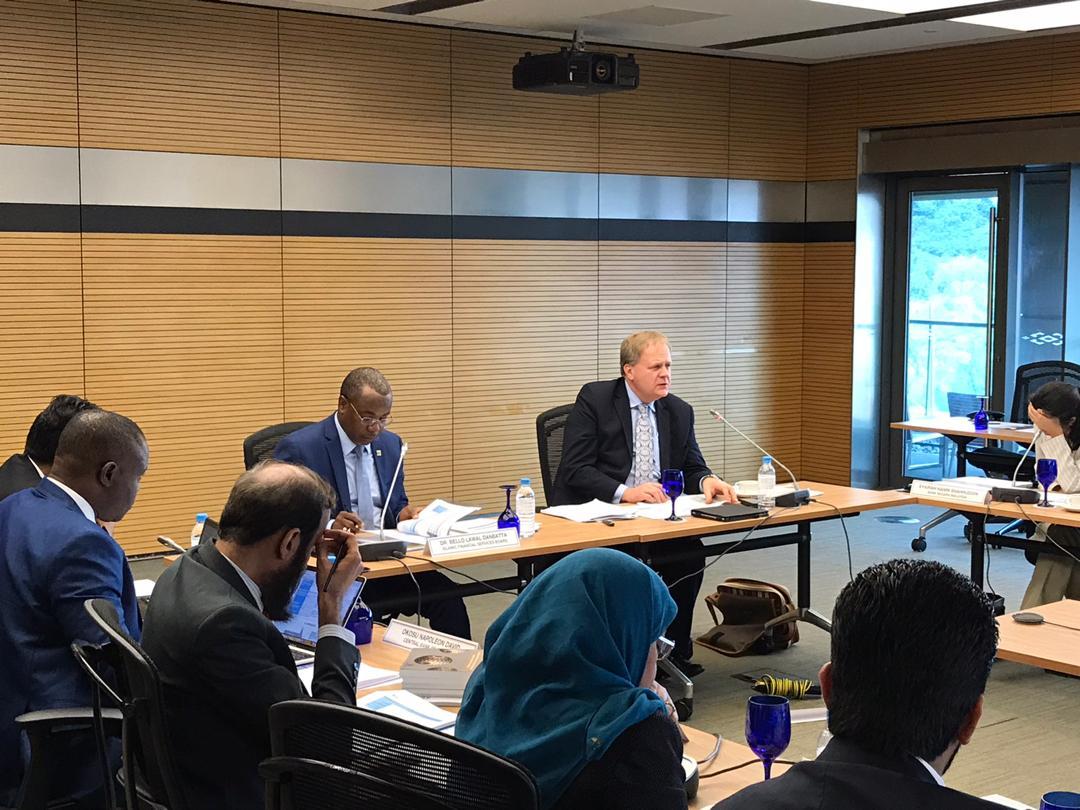

35th Islamic Financial Services Board (IFSB) Council Meeting and Side Events

Le Meridien Hotel Pointe Aux Piments, MauritiusThe 35th IFSB Council Meeting and Side Events are hosted by Bangladesh Bank. The details of the event are as follows: Tuesday, 10 December 2019 Presentation on Islamic Digital Wallet Lunch hosted by AIBL 20th Islamic Financial Stability Forum Welcome Dinner hosted by Bangladesh Bank (for IFSB members ONLY) Thursday, 11 December 2019 35th IFSB Council Meeting (closed session and by invitation ONLY) Participation in the 35th IFSB Council Meeting and Side Events is by invitation only. Please email your enquiries to Ms. Nissa at [email protected] and Mrs. Ida Shafinaz at [email protected] The IFSB and Bangladesh Bank look forward to welcoming members of the IFSB and Islamic finance industry stakeholders to Dhaka, Bangladesh.